Traditional Defined Benefit Plan FAQs

Traditional Defined Benefit Plans

-

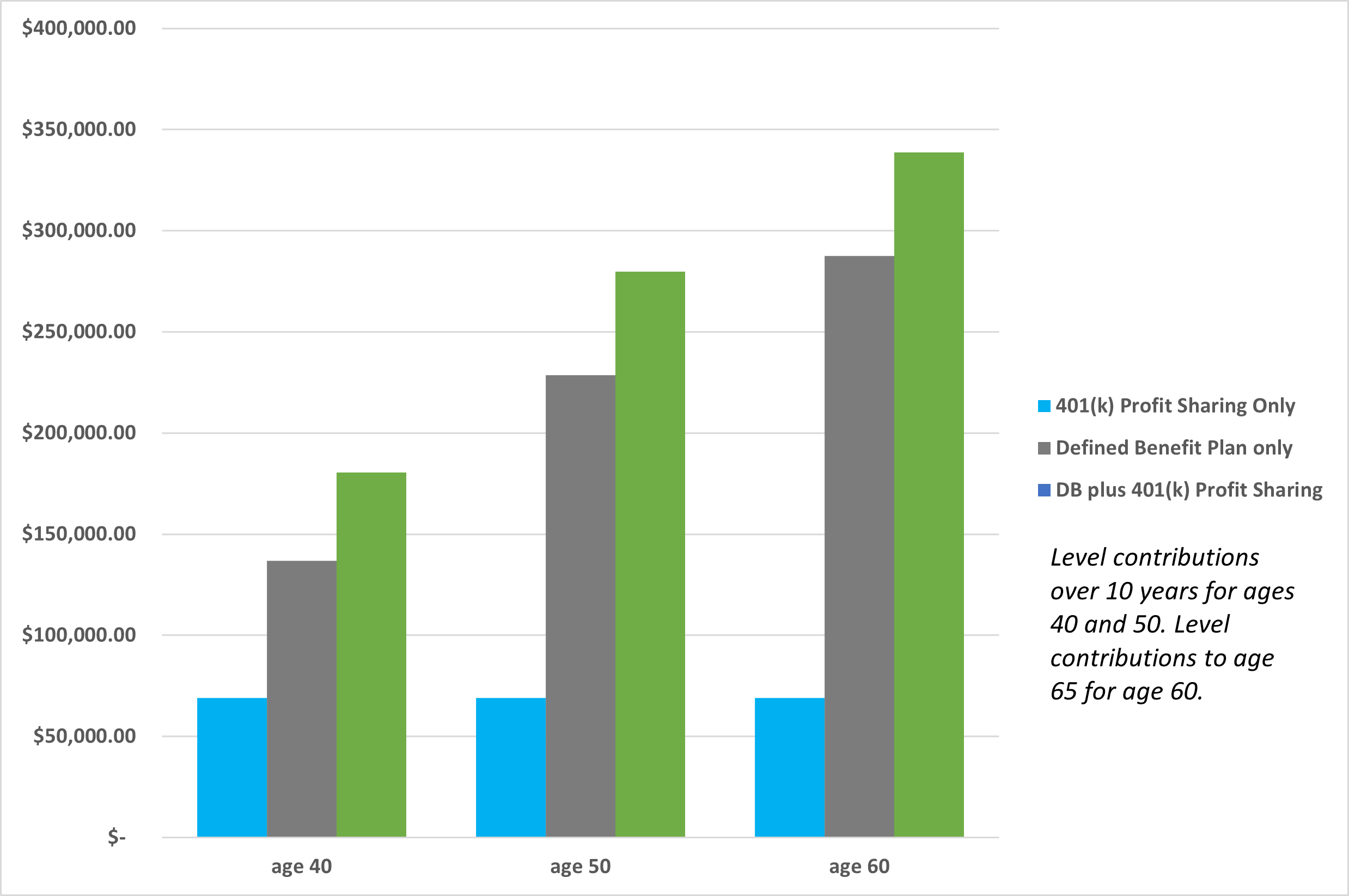

Defined Benefit Plan contributions are a function of both compensation and age. The older you are, the more you can contribute.

Back to top

-

Absolutely! In fact, administration of a Defined Benefit Plan is very streamlined and easy for a company with no employees.

Back to top

-

While Defined Benefit Plans do have minimum required contributions, there is also a fair amount of flexibility both in the plan design and in contribution policy that can assure that the annual minimum is well within your comfort level. You also are allowed to significantly front-load the contributions creating a reserve that lowers future funding requirements. It is not unusual for a 3 or 4-year-old Defined Benefit Plan that has been well funded to have a zero required minimum contribution but a maximum deductible contribution of several hundred thousand dollars.

Back to top

-

If your business is a “Specified Service Business” and is an S corp, partnership or sole proprietorship, a large pension plan deduction could bring your adjusted gross income below the applicable threshold under section 199A of the new tax law ($315,000 if married filing jointly, $157,500 if single). This will allow you to take advantage of the special 20% deduction. Read our July 2018 Pension Trends Newsletter for a more in depth look at the deductions under the new tax law.

Back to top

-

Generally, you should be prepared to sponsor the plan for at least 3 – 5 plan years.

Back to top

-

No. Once you are ready to retire or stop making contributions, you can terminate the plan, convert the benefit to a Lump Sum equivalent amount and roll those funds into an IRA. This will preserve the tax deferred status of the assets without requiring the business to continue maintaining a qualified plan.

Back to top

-

Retirement rules require that you cover at least a certain number of your employees. The number of employees as well as the amount of benefit you must provide depends on your company’s specific demographics. For an idea on what this might mean for your company, call one of our consultants at 503.520.0848.

Back to top

-

Defined Benefit Plan benefits can be based on the highest three consecutive years of compensation in your entire history with your business. This means as long as you have significant compensation in the past, you do not need current compensation to make a significant contribution. This is one of the principal advantages of a Defined Benefit Plan over a Defined Contribution Plan!

Back to top

-

The process required to terminate a plan depends on your type of business and whether or not you have employees. Contact one of our consultants to discuss your particular circumstances.

Back to top

-

Absolutely! For more information read our February 2019 Pension Trends Newsletter and contact one of our consultants.

Back to top

-

Yes, and probably not. Contact us to discuss the pros and cons.

Back to top

-

Yes. Although we recommend that benefit levels not be changed too frequently, a Defined Benefit Plan can generally be amended to increase, decrease or even eliminate benefits for any or all participants. Note though that such changes cannot reduce any benefits that have already been earned.

Back to top

-

Feel free to call one of our consultants at 503.520.0848 or send us an email. We do not charge for an initial consultation or plan design recommendation.

Back to top

-

Retirement plans are permitted to invest in real estate, but it is rarely the best idea for small plans. Read our September 2014 Pension Trends Newsletter for more details on the pros and cons of this type of investment.

Back to top

-

You can take a loan from the plan if your plan provisions allow for this. There are certain limits and other requirements that must be met to avoid taxes or penalties.

Back to top

-

Not at all! We set up over 79 new plans for small businesses last year.

Back to top

-

Annual administration fees start at $2,750 per year. For a more specific quote contact us or give us a call at 503.520.0848.

Back to top