Retirement Plan Basics FAQs

Retirement Plan Basics

-

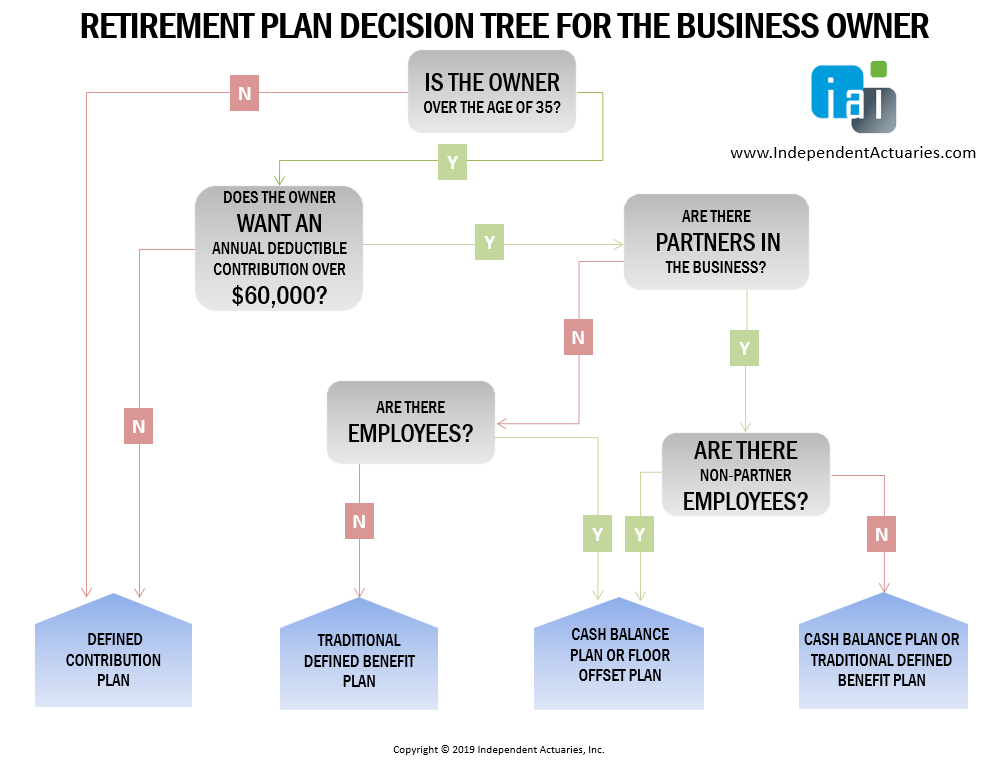

The best way to determine what the best plan is for your particular circumstances and objectives is to contact one of our consultants. In the meantime, the decision tree below may help you understand some of the factors that make one type of plan fit your needs better than another:

Back to top

-

It’s all in the name. Defined Contribution Plans (e.g. 401(k) plans, profit sharing plans, money purchase plans, SEPs, SIMPLEs) have the terms of the contribution defined (e.g. the employer contributes 5% of pay for participants each year). The contribution is known, but the benefit at retirement is uncertain.

Defined Benefit Plans (pension, Cash Balance, Floor Offset) have the terms of the benefit at retirement defined (e.g. an Annuity equal to 5% times Average Monthly Compensation for each year of benefit service payable for life beginning at age 62). The benefit at retirement is known, but the annual contributions to fund that benefit are uncertain.

Other major differences:

Back to topDefined Contribution Plan Defined Benefit Plan Investment Risk Borne by the employee Borne by the employer Maximum Limits Contribution is limited Benefit is limited Contribution Requirements Generally discretionary Generally, there is a required annual minimum Annual Contributions Limited to $69,000 ($76,500 if over age 50 in 2024) Wide range with upper limit $200,000+ depending on age Compensation Requirements Need high current compensation to maximize benefits Not dependent on current compensation level (based on high three-year average)

-

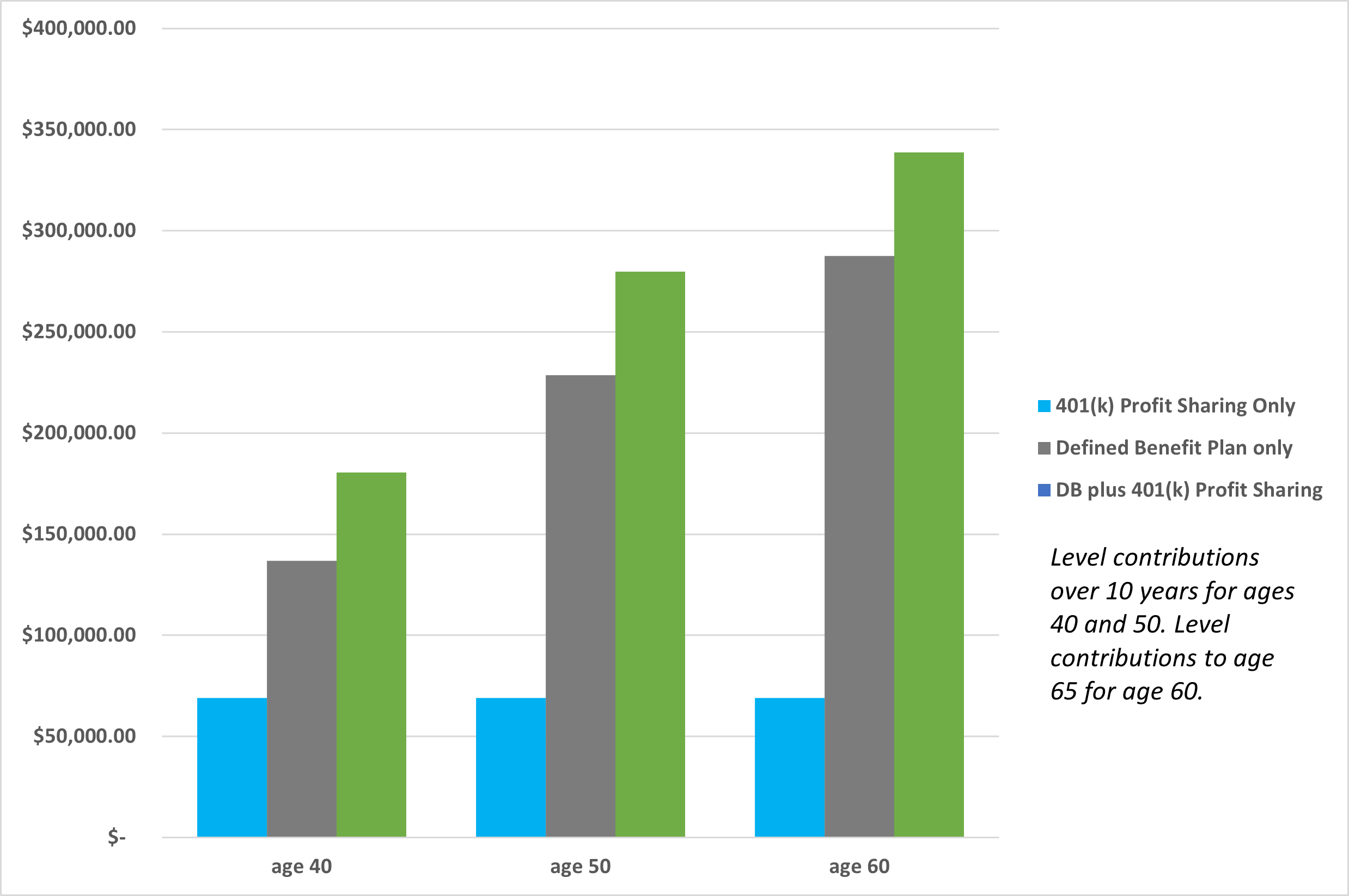

Unlike Defined Contribution Plans, such as 401(k) and profit sharing plans, in which deductible contribution limits are generally uniform for everyone, the maximum deductible amounts in a Defined Benefit Plan vary considerably by age, with much larger contributions possible for older individuals.

Back to top

-

Principal advantages of a Defined Contribution Plan:

- Appreciated by employees

- Easy to understand

- Extremely flexible

- Generally discretionary contributions

Principal Disadvantages of a Defined Contribution Plan:

- Low contribution limits

- Not designed to be a plan primarily for Owners

- Difficult to build or replenish sufficient retirement savings in short period of time

- Need high current compensation to maximize contribution

Principal Advantages of a Defined Benefit Plan:

- Substantially higher contribution limits

- Greater assurance of achieving retirement goal

- Generally higher benefits for Owners relative to rank and file employees

- Wide range of allowable contribution provides some flexibility

- Current salary not necessary to make a contribution

Principal Disadvantages of a Defined Benefit Plan:

- Not as well understood

- Underappreciated by employees

- Minimum employer contributions are usually required

-

Yes, and as a matter of fact we often recommend two plans in order accomplish certain objectives. A combination of a Defined Benefit Plan and Defined Contribution Plan can help manage employee contribution levels, increase flexibility, spread investment risk and optimize Owner contribution levels. Common plan designs that utilize this “DB / DC combo” strategy are Floor Offset Arrangements and Cash Balance Plans.

Back to top

-

Defined Benefit Plans generally have a minimum required contribution each year. It is important to have a plan design that accommodates your objectives and is affordable so that you can meet these requirements each year. If you do not make a required contribution, your company would be subject to penalties until the contribution is deposited.

Defined Contribution Plans may have required contributions depending on the type of plan, whether it has a “safe harbor” provision or whether it is combined with another plan for “nondiscrimination testing.”

Back to top

-

Compensation or “earned income” for purposes of retirement plan benefit calculations is generally the sole proprietor’s net Schedule C or K-1 income minus ½ of self‐employment tax minus the retirement plan contributions.

Back to top

-

Generally, contributions to a qualified plan are deductible for a given year to the extent that such contributions do not exceed net Schedule C income minus ½ of the self‐employment for that year.

Back to top

-

Yes, like any ERISA qualified retirement plan, assets are generally protected from corporate creditors.

Back to top

-

When a retirement plan is terminated, all benefits are fully vested and must be distributed to the participants. The form of distribution is generally elected by the participant. The most common form of distribution is a rollover to an IRA equal to the single sum value of the plan benefit. There would be no tax due and no early withdrawal penalty. Alternatively, a participant could take the money directly as a taxable distribution or elect to receive an Annuity (if the plan provides for this option). This latter option would require the plan to purchase an individual annuity contract from an insurance company.

Back to top

-

You are not allowed to discriminate in favor of Highly Compensated Employees (HCEs). This means you are required to cover a minimum number of employees and to provide a certain level of benefits to your non-highly compensated employees. In order to determine if the plan is complying with these requirements, we perform annual nondiscrimination testing. These tests can be pretty complicated and results can vary dramatically depending on the demographics of your employee group, so be sure to let your consultant know right away if there have been any significant changes.

Back to top

-

Visit our Plan Sponsor Responsibilities Page for more information.

Back to top

-

Generally, a Required Minimum Distribution is a taxable distribution from a qualified retirement plan upon attainment of age 70½. This is similar to the requirement that an IRA holder begin taking distributions from the IRA at attainment of age 70½.

If the participant is a “more than 5% Owner”, s/he is required to begin taking distributions each year from the plan, beginning with the calendar year in which s/he reaches age 70½. If the participant is not a “more than 5% Owner”, s/he may defer taking his distribution until s/he actually terminates employment.

Back to top

-

The amount that must be taken from a plan to satisfy the RMD rules will depend on the type of plan and that plan’s provisions. Contact your plan consultant if you or one of your employees is approaching age 70½.

Back to top